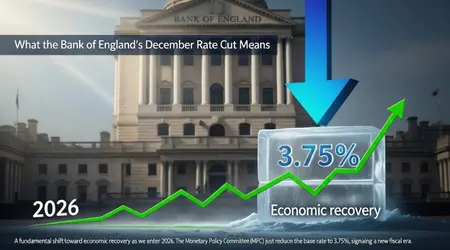

What the Bank of England’s December Rate Cut Means for the UK Economy in 2026

What the Bank of England’s December Rate Cut Means is a fundamental shift toward economic recovery as we enter 2026.

The Monetary Policy Committee (MPC) just reduced the base rate to 3.75%, signaling a new fiscal era. This decisive move on December 18, 2025, aims to breathe life into a cooling labor market.

By lowering borrowing costs, the Bank seeks to stimulate household spending while inflation finally hovers closer to the elusive 2% target.

How Does the Rate Cut Impact Your Personal Finances?

The primary result of What the Bank of England’s December Rate Cut Means is immediate relief for millions of UK households.

As the base rate drops to 3.75%, variable-rate mortgages and personal loans will see corresponding decreases in monthly repayments.

Families previously squeezed by high interest will find extra “breathing room” in their monthly budgets.

This injection of disposable income is expected to support retail and hospitality sectors throughout the first quarter of 2026.

What Happens to Mortgage Repayments and Housing?

Mortgage holders on tracker or standard variable rates will see their costs fall almost instantly.

This reduction can save the average homeowner hundreds of pounds annually, providing a vital cushion against lingering high energy costs.

First-time buyers also benefit as lenders ignite a “mortgage war,” lowering fixed-rate products to attract new business. Experts predict this will push house prices up by approximately 2% to 4% over the next year.

Why Are Savers Feeling the Pinch of Lower Rates?

While borrowers celebrate, savers face a diminishing return on their cash deposits.

Many high-street banks have already begun lowering the interest paid on easy-access accounts and fixed-term ISAs following the December announcement.

Investors may now look toward equity markets or property to achieve higher yields. This shift in capital allocation is a classic byproduct of What the Bank of England’s December Rate Cut Means.

How Does This Decision Influence Consumer Spending?

Lower debt servicing costs naturally encourage consumers to spend rather than save. When the cost of borrowing for a car or home improvement falls, economic activity tends to accelerate across the high street.

Retailers are optimistic that the “wealth effect” from rising house prices will boost consumer confidence. This psychological shift is essential for driving the UK’s GDP growth toward the projected 1.3% in 2026.

What is the Real-World Effect on Small Businesses?

Small and medium-sized enterprises (SMEs) often rely on floating-rate debt to manage daily operations. A lower base rate reduces their overheads, allowing for potential expansion or much-needed hiring in a softening labor market.

Lower costs enable businesses to maintain competitive pricing despite higher national insurance contributions.

This balance is critical for sustaining the disinflationary trend that the Bank of England has fought to establish.

Why is the UK Economy Projected to Stabilize in 2026?

The logic behind What the Bank of England’s December Rate Cut Means is rooted in long-term stability. By easing policy now, the Bank prevents a deeper recessionary slide as the effects of the Autumn Budget take hold.

Current forecasts suggest that inflation will settle near the 2% mark by Spring 2026. This stability allows businesses to plan long-term investments with greater certainty, moving away from the “crisis mode” of previous years.

What is the Current State of UK Inflation?

Inflation fell sharply to 3.2% in November 2025, driven largely by a slowdown in food and clothing prices. This gave the MPC the “green light” to implement the quarter-point cut during their December meeting.

Core inflation, which excludes volatile energy and food prices, has also cooled significantly.

This broad-based easing suggests that What the Bank of England’s December Rate Cut Means is a sustainable path toward price stability.

How Does the Labor Market Influence Future Cuts?

The labor market has shown signs of “building slack,” with unemployment rising to roughly 4.8% late in 2025. The Bank uses rate cuts to prevent unemployment from spiraling during periods of low growth.

Slower wage growth, now heading toward 3%, reduces the risk of a “wage-price spiral.” This allows the Bank to remain dovish, potentially eyeing further cuts in the first half of 2026.

What Research Highlights the Success of the Disinflation Process?

A recent report by ING Think highlighted that the UK is no longer an “inflation outlier.” Their analysis suggests that the Bank’s restrictive policy has successfully anchored expectations among both businesses and households.

The research indicates that the December cut was a “hawkish holiday gift.” It acknowledges progress while warning that the path to a “neutral” rate of 3% remains data-dependent and cautiously managed.

What Analogy Explains the Bank’s Current Strategy?

The Bank’s strategy is like a Pilot Landing a Plane. After flying through the turbulence of high inflation, the pilot is now gradually lowering the altitude (interest rates) to touch down smoothly.

If they descend too fast, they risk crashing (re-igniting inflation). If they stay too high, they run out of fuel (stifling the economy). What the Bank of England’s December Rate Cut Means is the start of that final, careful descent.

What are the Risks to the UK’s Economic Outlook?

Despite the optimism, What the Bank of England’s December Rate Cut Means is not without significant risks. Global geopolitical tensions and energy price volatility could still disrupt the fragile path toward 2% inflation.

Policymakers remain vigilant about “service inflation,” which remains stickier than goods inflation. If service costs jump, the Bank may be forced to pause further cuts, or even reverse course.

Why is Geopolitical Instability a Major Concern?

Disruptions in global trade routes can lead to “imported inflation.” If shipping costs or oil prices spike due to overseas conflict, the UK’s domestic rate cuts might not be enough to shield consumers.

The Bank must balance domestic easing with the strength of the Pound. A currency that weakens too much against the Dollar makes imports more expensive, potentially pushing inflation back up in late 2026.

How Does Fiscal Policy Interact with Interest Rates?

The government’s Autumn Budget introduced tax increases that some economists fear will dampen growth. Rate cuts serve as the “monetary counterweight” to these fiscal pressures, attempting to keep the economy moving.

If the government spends more than anticipated, it could create excess demand. In such a scenario, What the Bank of England’s December Rate Cut Means would be a short-lived reprieve before rates rise again.

What is an Original Example of Business Response to the Cut?

A manufacturing firm in the Midlands recently paused a £2 million factory upgrade due to high borrowing costs. Following the December cut, they successfully renegotiated their credit line at a lower margin.

This move allowed them to greenlight the project and hire ten new technicians. This micro-level decision is a perfect example of how What the Bank of England’s December Rate Cut Means for the broader industrial landscape.

What Happens if Inflation Remains Above the 2% Target?

If inflation lingers at 3% throughout 2026, the Bank will likely hold rates at 3.5% or higher. They cannot afford to lose credibility by allowing high prices to become the “new normal” for British consumers.

Maintaining “restrictive” territory remains a possibility if pay growth doesn’t continue its downward trend. This creates a high-stakes environment where every monthly data release could shift the Bank’s next move.

UK Economic Indicators and Projections (2025-2026)

| Economic Indicator | End of 2025 (Actual) | Mid-2026 (Projected) | Impact of December Rate Cut |

| Bank of England Base Rate | 3.75% | 3.25% – 3.50% | Stimulates borrowing and spending |

| CPI Inflation Rate | 3.2% | 2.1% – 2.5% | Eases cost-of-living pressures |

| GDP Growth (Annual) | 1.4% | 1.3% | Prevents stagnation / supports recovery |

| Unemployment Rate | 4.8% | 5.1% | Mitigates sharper rises in joblessness |

| Avg. Mortgage Rate (2-yr Fix) | 4.6% | 3.9% | Improves housing affordability |

In summary, What the Bank of England’s December Rate Cut Means is a calculated bet on the UK’s resilience.

By reducing the base rate to 3.75%, the MPC is providing much-needed relief to a slowing economy while keeping a close watch on persistent service inflation.

For homeowners and businesses, this marks the beginning of a more manageable financial climate in 2026.

However, the path ahead remains narrow, requiring a delicate balance between growth and price stability.

As we move into the new year, the effectiveness of this cut will be measured by the strength of the British high street and the stability of the Pound.

Will the lower interest rates encourage you to make a major purchase in 2026, or are you staying cautious? Compartilhe sua experiência nos comentários!

Frequently Asked Questions

When is the next Bank of England interest rate meeting?

The Monetary Policy Committee is next scheduled to meet on February 5, 2026. This meeting will be crucial for determining if the December cut was a one-off or the start of a consistent downward trend.

Why did some MPC members vote against the rate cut?

The vote was a close 5-4 split. Those who voted to hold at 4% were concerned that inflation expectations have not yet shifted downward sufficiently and that wage growth remains too high to ensure a permanent return to the 2% target.

Will my savings account interest rate drop immediately?

Most likely, yes. While banks are slow to raise rates for savers, they are typically very quick to lower them following a central bank cut. It is a good time to shop around for the best fixed-term “catch” before rates fall further.

Is a 3.75% rate considered “low” by historical standards?

Not necessarily. While it is much lower than the 5.25% peak seen in 2024, it is still significantly higher than the near-zero rates experienced for the decade following the 2008 financial crisis. We are moving toward a “new neutral.”

Q: How does the rate cut affect the value of the Pound?

A: Generally, lower interest rates make a currency less attractive to international investors, which can lead to a slight decrease in value. Indeed, the Pound fell by 0.7% against the Dollar immediately following the inflation data and the subsequent rate cut anticipation.